Entry into force of a collective agreement for companies in the insurance sector

Entry into force of a collective agreement for companies in the insurance sector

After several months of negotiations, this agreement was signed between the various parties on Tuesday, June 4, 2024.

This agreement is concluded for a period of 3 years, i.e. for the period from 1 January 2024 to 31 December 2026

This Agreement governs relations and general working conditions between insurance companies that are members of the ACA and their employees working permanently in the Grand Duchy of Luxembourg, with the exception of:

- Employees belonging to senior managers as defined by Article L-162-8 of the French Labor Code

- Apprentices whose status is governed by Articles L.111-11 et seq. of the Labour Code.

The Convention provides in particular:

1/ The payment of a conjunctural bonus for employees in service on June 15, 2024 and whose employment contract has not been terminated by the employee or terminated by the employer for serious misconduct on that date. For employees working part-time, the amount is to be paid in proportion to the working hours during a reference period extending from 1 June 2023 to 31 May 2024.

Employees on maternity leave on 15 June 2024 will benefit from the bonus corresponding to their category.

Employees on parental leave will benefit from the bonus corresponding to their category in proportion to the time during which their employment contract has fully produced its effects compared to the time it was suspended during a reference period from 1 June to 31 May 2024.

2/ The payment of an exceptional attractiveness bonus

An exceptional attractiveness bonus of:

- €500 gross is paid with September 2024 salaries to each employee in service and whose contract has not been terminated by 01.09 of the payment year concerned

- €400 gross is paid with the September 2025 salaries to each employee in service and whose contract has not been terminated by 01.09 of the payment year concerned

- €400 gross is paid with the September 2026 salaries to each employee in service and whose contract has not been terminated by 01.09 of the payment year concerned

For employees working part-time, the amount of the exceptional bonuses mentioned below to be paid is calculated in proportion to the working hours during a reference period extending from 01.01 of the payment year concerned to 01.09 of the departure year concerned.

For newly hired employees, the exceptional bonus to be paid is calculated in proportion to the time the employee is present over a reference period, i.e. 01.01 of the payment year concerned to 01-09 of the payment year concerned.

For employees who left the company before 01.09 of the payment year concerned, the exceptional bonus is prorated according to the working hours and the time of presence between 01.01. and the starting date of the relevant payment year

Each bonus is exceptional and does not form part of wages and salaries. Its payment does not generate an acquired right for the beneficiary employees.

3/ Increase in the starting scales for new recruits.

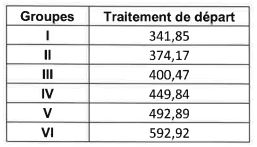

Departure salaries for new entrants after January 1, 2024 are as follows:

Severance salaries for employees hired before 1 January 2024 remain unchanged.

The basic salaries of employees in place on 01.01.2024. are adapted at least to the starting salary of the group concerned below.

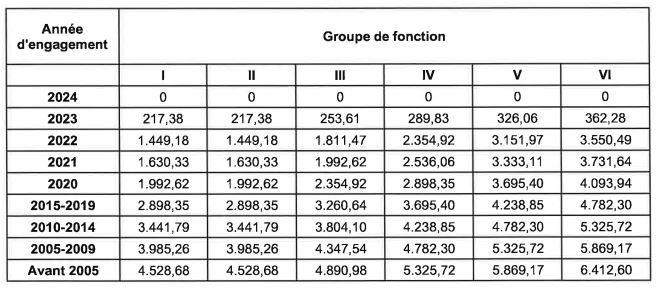

4/ Adaptation of only 1 and 2 for all employees

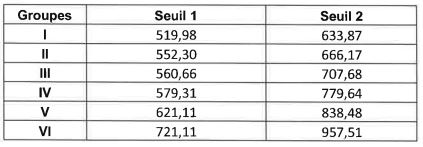

As a result of the increase in the thresholds, employees whose basic salary falls below thresholds 1 and 2 will be able to benefit from promotions:

Between the starting salary and threshold 1: each employee concerned is guaranteed an increase in his or her basic salary, calculated at index 100, of €18 (index 100) gross over a period of 3 years. All increases included in the basic salary are to be charged to this guarantee, except for the seniority bonus.

From threshold 1 to threshold 2: a minimum annual performance amount of €4 (index 100) gross to be granted to 67% of employees. He is also guaranteed an increase in his basic salary calculated at index 100 of €12 (index 100) gross over a period of 3 years. All increases taken into the basic salary are to be charged to this guarantee.

The performance remuneration awarded to employees who have reached or exceeded the threshold of 2 will be distributed to these employees in the form of an annual non-recurring bonus (payable in January)

5/ Hour of training on occupational health and prevention of psychosocial risks.

The social partners are committed to the prevention of psychosocial risks and the quality of life at work in general.

The companies, in collaboration with the staff delegation, are committed to the prevention of psychosocial risks in the medium and long term.

To do this, they will set up structured projects allowing each employee to get involved in this process by proposing improvements to their work and having the opportunity to develop their personal resources to better prevent and deal with the risks identified.

2 hours of the training credit will be dedicated to occupational health and the prevention of psychosocial risks

6/ Improvement bonus

The employee will be awarded a one-off bonus of €40 (ind 100) for every 40 hours of training taken outside working hours and during a reference period. which runs from September 1 to August 31 of the following year. Payment will be made at the end of the reference period

7/ Hour credit for the health representative

The safety and health delegate carries out his mission in compliance with the legal texts. The latter must have the time necessary to carry out his or her duties and within the limit of the following hour credits (defined according to the size of the company concerned):

-4 paid hours per month if the company employs between 15 and 25 employees during the 12 months preceding the 1st day of the appointment of the staff safety and health representative

-6 paid hours per month if the company employs between 26 and 50 employees during the 12 months preceding the 1st day of the appointment of the staff safety and health representative

-8 paid hours per month if the company employs between 51 and 75 employees during the 12 months preceding the 1st day of the appointment of the staff safety and health representative

-10 hours paid per month if the company employs between 76 and 150 employees during the 12 months preceding the 1st day of the appointment of the staff safety and health delegate

-4 paid hours per week if the company employs more than 150 employees during the 12 months preceding the 1st day of the appointment of the staff safety and health delegate

This overtime credit is reserved for the exclusive use of the delegate in charge of the safety and health of staff.

8/ Background Check

Background checks are a well-known process by which a company verifies that a person is who they say they are. Companies check a person's criminal record, education, employment history, and other activities that occurred in the past to confirm their validity. This check may take place during the recruitment process and/or during the contractual employment relationship, in particular when these checks are required by the regulator as part of its control mission (for example: criminal record check of an employee who would also have the status of agent, or of a candidate for a position of office).

The companies that are signatories to this collective agreement undertake to conduct these processes within the framework of the existing legal provisions (in compliance with the provisions of the General Data Protection Regulation)

Enlighten your future

Enlighten your future