Adoption of the income tax brackets raised up to 4 index points

Adoption of the income tax brackets raised up to 4 index points

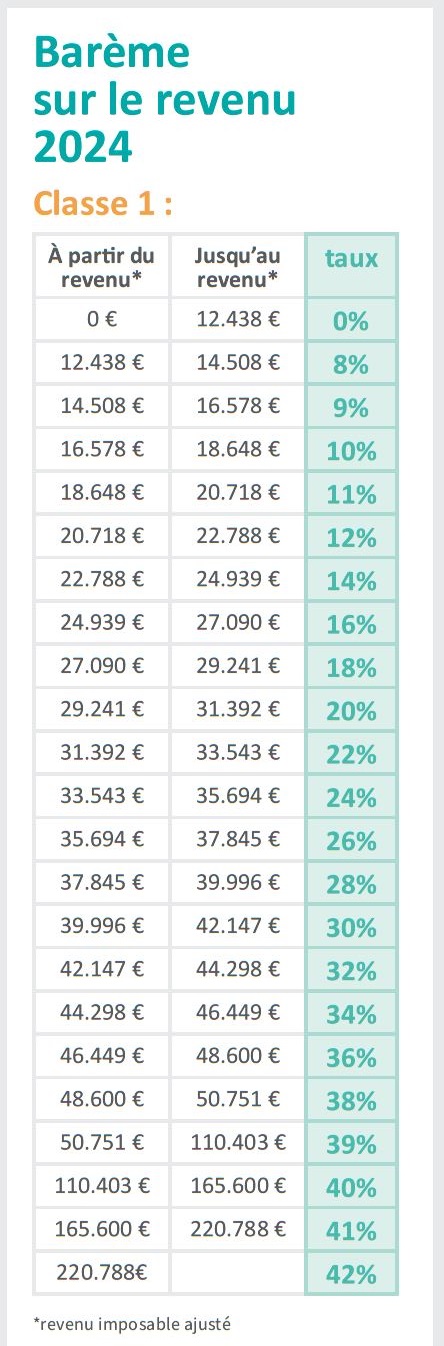

On November 27, 2023, the government presented the project of the Bill 8343 which aims to increase from January 1, 2024 the income tax brackets by 10.38% (compared to the rate applicable since 2017). It corresponds to 4 index points.

This decision intervenes in a difficult economic context and should thus make it possible to reduce the tax burden on households and thus strengthen their purchasing power. This will therefore also benefit businesses and businesses.

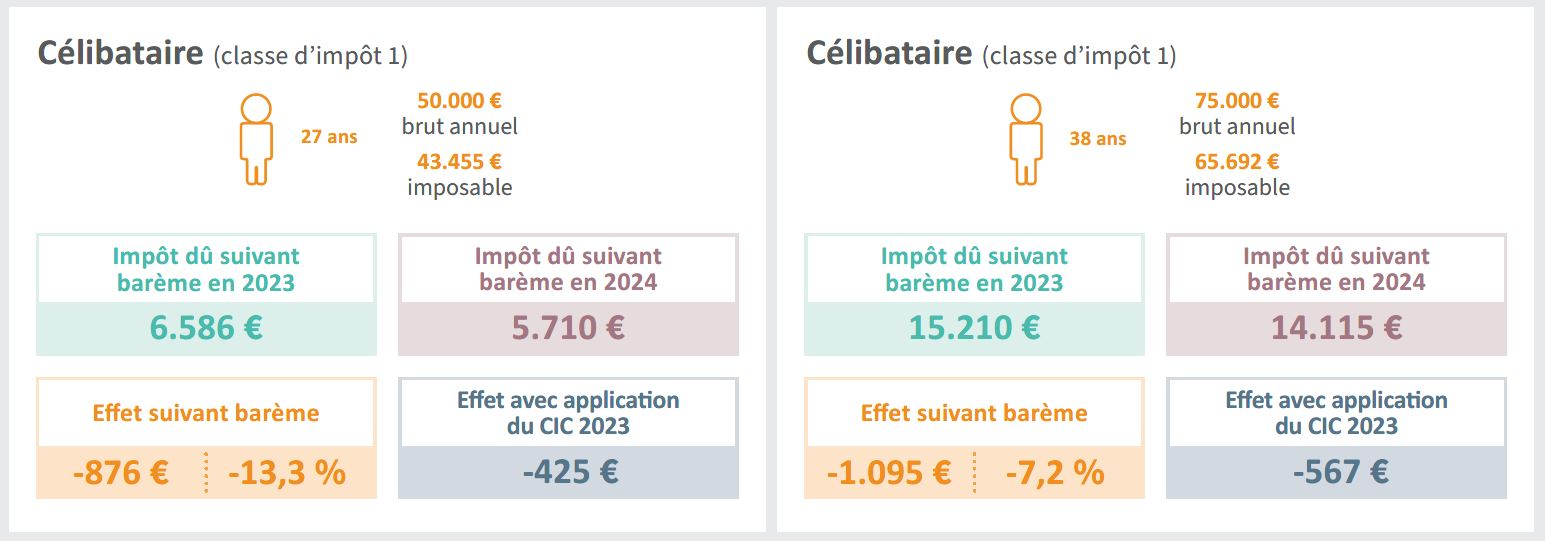

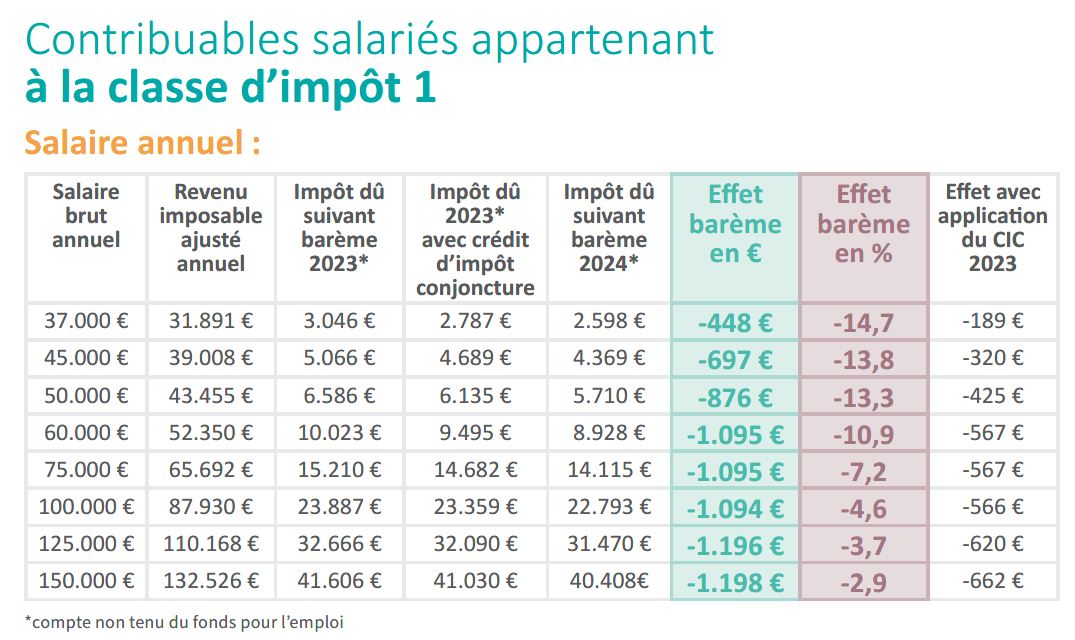

Thus, a taxpayer in tax class 1 with an annual gross salary of 75,000 euros has an annual net gain of 1,095 euros in 2024.

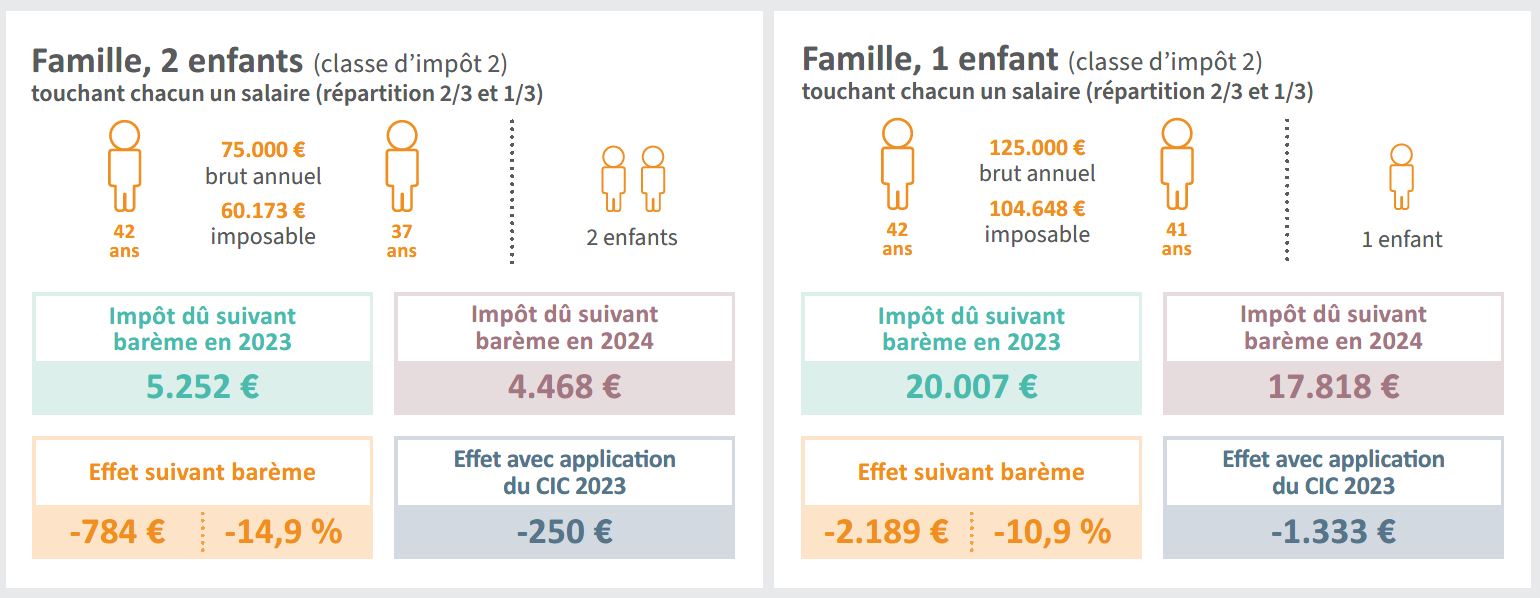

A couple with a gross annual total of 125,000 euros (of which the salary of the first person represents 2/3 and that of the second 1/3), the effect compared to 2023 amounts to 2,189 euros. Their tax burden will therefore decrease by 10.9%.

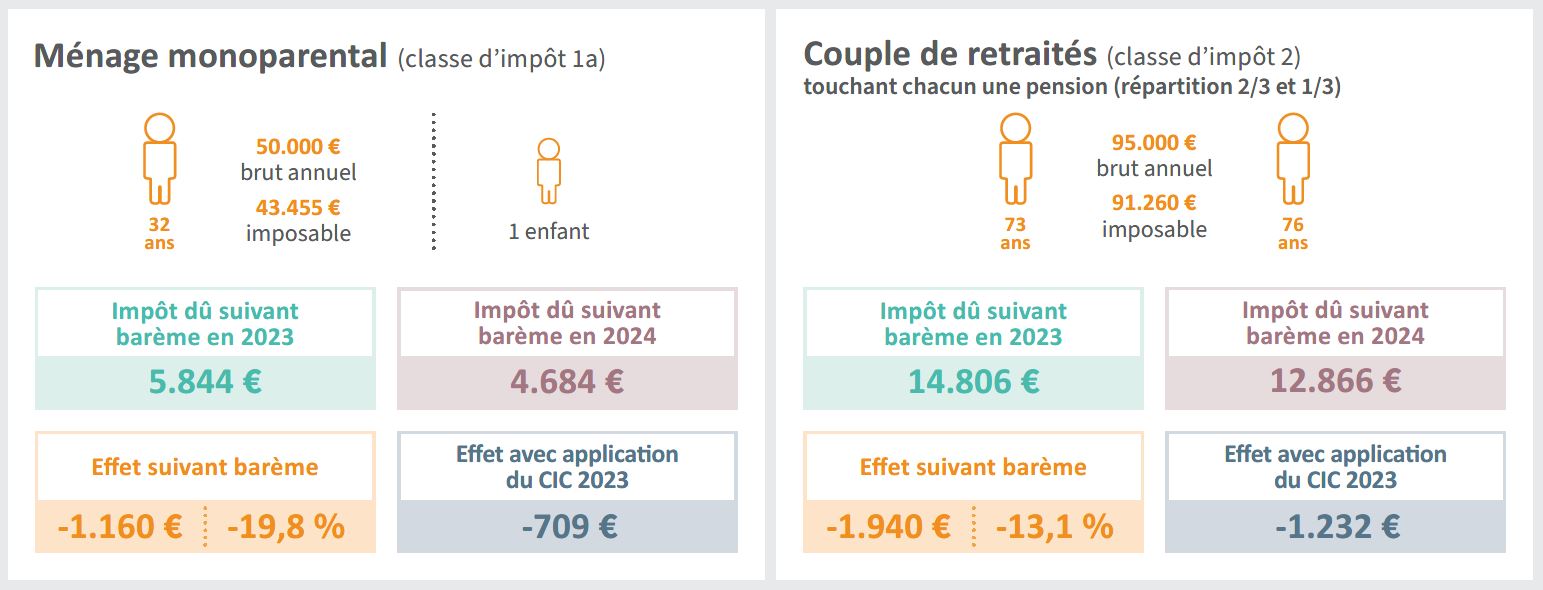

A taxpayer in tax class 1a with an annual gross salary of 50,000 euros has, due to the adoption of the Bill, 1,160 euros more in 2024. This corresponds to a reduction in the tax burden of 19.8%. Taking into consideration the ETC applicable in 2023, the effect amounts to 709 euros.

This bill also provides for the adaptation to the evolution of the price index of the revaluation coefficients which have the effect of eliminating inflation in the calculation of taxable capital gains.

Concerning the adoption of the brackets of the income tax scale, here are some examples with figures in the tables below.

Enlighten your future

Enlighten your future